Report: Sales Analysis

| Related Pages |

| Related Categories |

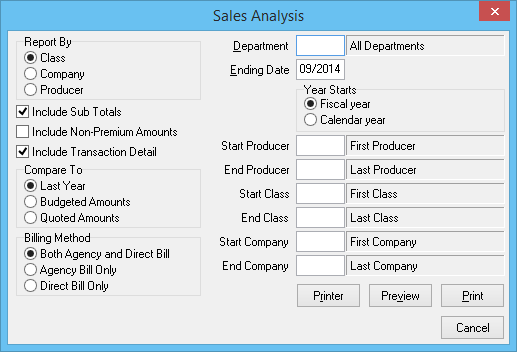

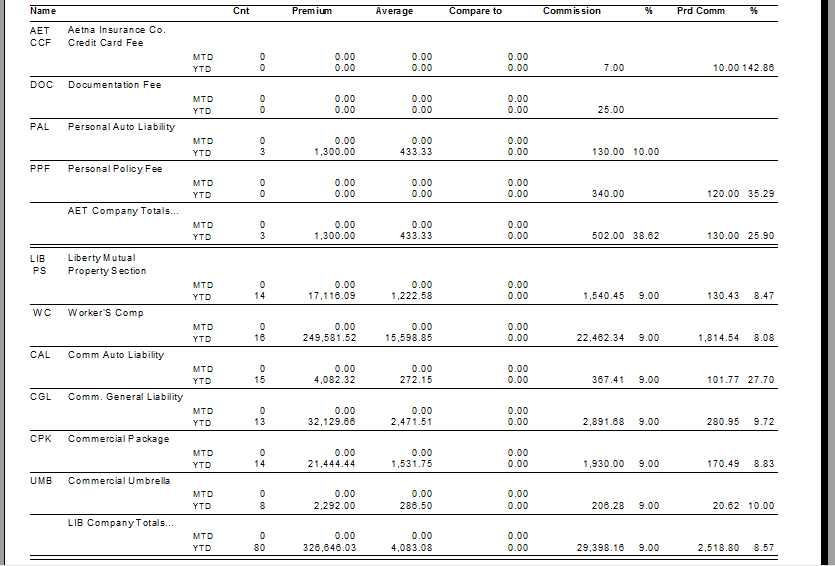

The Sales Analysis report is used to analyze the sales for your agency by reporting the invoiced premium earned year-to-date by client, class, company, or producer. The report can then be compared to the previous year's Sales Analysis report, or to estimated budget or quoted amounts. (The report only includes invoiced premium, not estimated annualized premium amounts).

There are a number of different detail levels available, depending on how the data should be organized. For example, the report output can include only a single line for each company, or optionally expanded to include class of business sub-totals for each company.

The report can be completed according to Fiscal Year, or Calendar year.

Contents

Access and Security Options

The sales analysis can be opened by selecting Reports -> Sales Analysis -> by Client, Class, Company or Producer.

Access to the sales analysis is controlled through the security system A/R -> Sales Analysis -> View setting.

Report Window Options

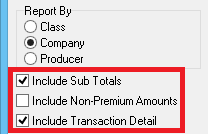

Include Sub Totals and Include Transaction Details

The options control the amount of detail, per primary grouping that is included.

For example:

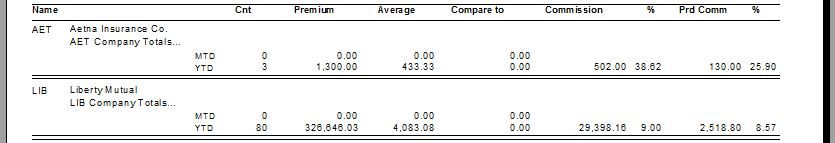

- Sales Analysis by Company, No Sub Totals, and No Transaction Detail.

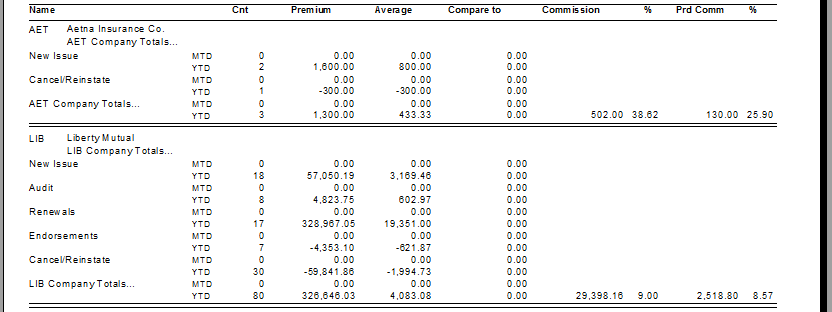

- Sales Analysis by Company No Sub totals, and With Transaction Detail.

- Sales Analysis by Company With Sub totals, and No Transaction Detail.

Compare To

- Last Year: Compared to previous year sales in the same period.

- Budget Amounts: Compared to the balances entered for budgeting.

- Quoted Amounts: Compared to the balances entered for static (estimated) budgeting.

Report Details

The report has not been designed to tie with any financial reports.

The report only includes invoices and Binders for the specified period and does not include any other type of transaction such as Journals, Cash, or Checks.

Installment Invoices are reported as a lump-sum, while financial reports only report on the installment balance that is effective in the report period.

Premium Amount:

- Premium amounts will tie to the Invoice Register for the same period as long as installment invoice balances are not included.

- The Invoice Register must include Binders to obtain correct balances.

Agency Commission:

- Agency Commission will balance with the Report: Income and Expense account 4110 & 4120, if installments are not included in the balance and there are no other transactions posted directly to these income accounts.

- The Income and Expense report only includes balances for installments that are within the report period.

Producer Commission:

- The Producer Commission will balance with the Balance Sheet account 2120 if installments are not included in the balance and there are no other transactions posted to 2120.

- The Producer Statement will not match with the Sales Analysis balance since the Producer Statement includes all transaction types and only includes installments that fall within the report period.