General Ledger Profile

| Related Pages |

| Related Categories |

The General Ledger Profile screen is a list of General Ledger codes available when entering accounting transactions including:

- Cash, Check, and Journal Transactions

- Vouchers and Non-Policy Related Multi-GL Checks (legacy)

- Invoice Transactions

- Balance Sheet, GL Inquiry, and Income & Expense reporting.

Contents

Before You Begin

Access to view the General Ledger Profile requires the current operator to have Security System: Profiles -> General Ledger -> View access.

![]() See: Security System for more information.

See: Security System for more information.

Create a General Ledger Account

| G/L Type | G/L Code | G/L Settings |

| Asset | 1100 - 1999 | Current, Fixed, Other |

| Liability | 2000 - 2299 | Current, Long-Term, Other |

| Capital | 2300 - 2999 | No Sub-Types |

| Income | 4100 - 4999 | Operating, Miscellaneous |

| Expense | 5000 - 6999 | Administrative, Sales, Other |

Before creating a new general ledger account, first verify a similar account does not already exist. Select Print List to preview a report of all existing general ledger accounts. The name assigned to an account code can be modified, without creating a new general ledger account.

- From the Main Menu, select Setup -> General Ledger.

- Select Create New.

- Enter the desired four digit number. (See table for guidance)

- Enter the name for the account. This name will appear in drop-down selection lists when entering data, or running reports.

- Select the G/L Type and G/L Sub-Type. (See table for guidance)

- Select the Sub-Account Type.

A GL account that has been used for accounting entries cannot be changed to no sub accounts.

A GL account that has been used for accounting entries cannot be changed to no sub accounts.

- Most GL accounts do not have a sub-account.

- When a sub-account type is set, any accounting entry requires both the primary gl number, and a sub-account. (Client, Producer, Company etc)

- Select the desired G/L Inquiry Report Options setting. (See Report: GL Inquiry)

- Totals Only - Total for all type of transactions

- Monthly Totals - Breaks down totals by month

- All Details - Breaks down detail for all transactions (Invoice GLs (1120, 1130 ,2110 ,2120 etc.) do not provide full details unless enabled by Agency Systems Customer Support.)

- Select the desired Report Subtotals Selection setting. (Subtotals by department

- Select Save. (Requires Security System: Profiles -> General Ledger -> Entry access.)

- Select Exit.

Edit a General Ledger Account

Required general ledger accounts cannot be deleted or edited.

- From the Main Menu, select Setup -> General Ledger.

- Select Find.

- Select the desired general ledger number and select OK.

- Enter or modify any desired values. (Examples: Name, GL Inquiry Report Options, Report Subtotals).

- Select Save. (Requires Security System: Profiles -> General Ledger -> Edit access.)

- Select Exit.

Edit the G/L Type or G/L Sub-Type

- Question

- Is there a way to change the G/L Sub-Type for an existing expense account?

- Answer

Yes. To change the G/L Sub Type for an account (Expense or otherwise) requires running a utility to update the data used by the Income and Expense Report.

Please call contact Agency Systems support for assistance deleting and re-entering the account.

Delete a General Ledger Account

Deleting a General Ledger Account should not be done if the account has ever been used for any accounting transactions.

A daily password is required to delete a general ledger account. The daily password is available by contacting Agency Systems support.

Required general ledger accounts cannot be deleted or edited.

Step A: Verify any Previous Accounting Transactions

- Select Reports -> General Ledger Detail. (Requires Security System: GL -> General Ledger Inquiry -> View access.)

- Enter G/L -> XXXX: GL Account Number.

- Enter Start Date -> Start of Time. (Right-Click)

- Enter End Date -> End of Time. (Right-Click)

- Select Preview.

Step B: Delete the Unused General Ledger Account

First, verify the general ledger account has never been used.

- From the Main Menu, select Setup -> General Ledger.

- Select Find.

- Select the desired general ledger account and select OK.

- Select Delete. (Requires Security System: Profiles -> General Ledger -> Global access.)

- Confirm Yes.

- Enter the password provided by Agency Systems support.

- Select Exit.

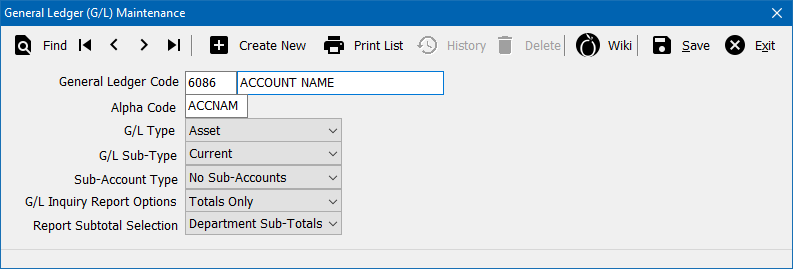

General Ledger Profile Interface

From the Main Menu, select Setup -> General Ledger.

- General Ledger Profile Toolbar

- Find: - Find a general ledger profile.

- First: - Skip to the first general ledger profile.

- Previous: - Skip to the previous general ledger profile.

- Next: - Skip to the next general ledger profile.

- Last: - Skip to the last general ledger profile.

- Create New: - Create a new general ledger profile.

- Print List: - Print a list of general ledger profiles. (A spreadsheet for the full chart of accounts can also be exported.)

- History: - View general ledger profile history.

- Delete: - Delete general ledger profile.

- Wiki: - Wiki Help Documentation.

- Save: - Save the current profile item. (ALT + S)

- Exit: - Exit the profile windows. (ALT + X)

Required General Ledger Accounts

Newton requires certain General Ledger accounts to be setup in order for the accounting transactions to post properly. The accounts are pre-configured, and should not be edited.

Asset Accounts

1100 - Cash in Bank: This account is used to post Cash and Check transactions in Agency Systems. General Ledger 1100 is used when a new bank is setup in Agency Systems. It is setup as a Current Asset with Bank Sub Accounts defined.

1120 - Client Accounts Receivable: Each client/agent setup in Agency Systems is assigned a client number under 1120. This account is reflected when a client makes a payment, a check for returned premium, and all types of invoices created in Agency Systems. This account is setup as a Current Asset with Client Sub Accounts defined.

1130 - Company Accounts Receivables: This account is normally used when Direct Billed invoices are created. When posting the check received from the Insurance Carrier, the cash receipt is posted to the 1130 account. This account is setup as a Current Asset with Company Sub Accounts defined.

Liability Accounts

2110 - Company Accounts Current Payable: Agency Billed invoices are posted to this account. The check to the Insurance Company is cut to this account when you post the check less your Agency Commission. This account is setup as a Current Liability with Company Sub Accounts defined.

2120 - Producer Commission Payable: On all invoice transactions, the 2120 account is reflected by the Producer Commission amount on an invoice. Producer Statements can be produced for all commission based producers in your agency. This account is setup as a Current Liability with Producer Sub Accounts defined.

2130 - Vendor Payable: Vendors setup under the Profiles menu can have non policy related checks created in the system. A Check Register can be run for a particular vendor code based off this account. This account is setup as a Current Liability account with Company Sub Accounts defined and Use as Vendor selected.

Capital Accounts

2303 - Bank Transfer: See Bank Transfer for details and setup instructions. (The GL number can be changed as desired.)

2318 - Retained Earnings: Automatically calculated and displayed on the Balance Sheet based off the the previous fiscal year's ending Profit or Loss amount.

2319 - Profit or Loss: Automatically calculated based off the Income & Expense total and displayed on the Balance Sheet.

- The assigned General Ledger code for the Retained Earnings and Profit or Loss capital accounts can be reconfigured in the Agency Profile -> Accounting Setups tab.

Operating Income Accounts

4110 - Agency Billed Commission Income: All invoices entered into Agency Systems of type Agency Billed will post to this account. The Income and Expense Report will show the amount of Agency Billed income for a specified period of time. This account is setup as an Operating Income account setup with no sub accounts defined.

4120 - Direct Billed Agency Commission: All invoices entered into Agency Systems of type Direct Billed will post to this account. The Income and Expense Report will show the amount of Direct Billed income for a specified period of time. This account is setup as an Operating Income account with no sub accounts defined.

Operating Expense Accounts

5108 - Commission Expense: Agency and Direct billed invoices are posted to this account. An Income and Expense report will show this amount for a specified date range. This account is setup as a Sales Expense with no sub Accounts setup.

5109 - Commission Expense: Broker billed invoices are posted to this account. An Income and Expense report will show this amount for a specified date range. This account is setup as a Sales Expense with no sub Accounts setup.