Invoice: Edit An Invoice

| Related Pages |

| Related Categories |

Invoices on policies or quotes can be edited if the general ledger period is open, the user has sufficient security access, and accounting transactions are not attached to the part of the invoice.

Contents

Before You Begin

An invoice cannot be edited if the general ledger period is closed. See: Invoice: Adjust Premium and Commission on Existing Invoices in Closed GL Periods.

- For policy invoices, requires Other -> Security System -> AR -> Policy Transaction -> Edit.

- For quote invoices, requires Other -> Security System -> AR -> Quoted Transaction -> Edit.

Edit an Invoice

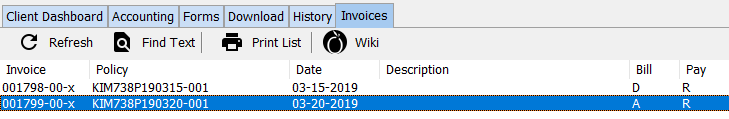

- Load a client on one of the client tabs.

- Select the Invoices tab at the top.

- Double-Click to open the desired invoice in Policy & Billing. (Alternatively, open the invoice in Policy & Billing using the accounting tab or the Policy Dashboard)

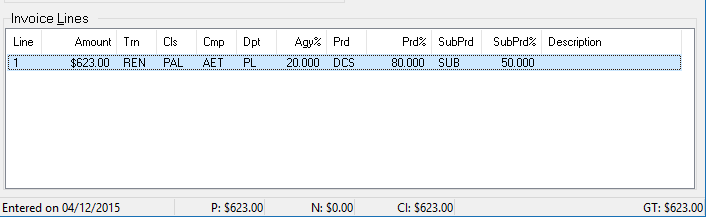

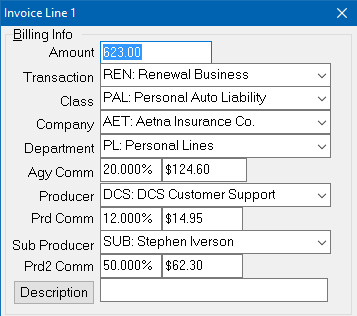

- Double-click to open the invoice line at the bottom.

- Edit the premium, or any other part of the invoice. If the field is disabled, see the section below.

- Select Finish, then Save.

- Select Exit to close Policy & Billing.

Edit an Invoice Without Unapplying Accounting Transactions

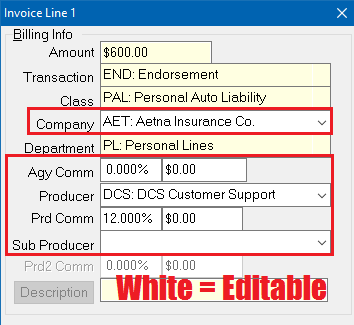

Invoice lines can be edited without unapplying accounting transactions if the items are attached to other sides of the invoice.

For example, on an Agency Billed invoice in an open GL period with only a client payment attached (GL-1120). The company and producer can still be adjusted (GL-2110, GL-2120).

- When can this be used?

- Only retail invoices on retail clients can be altered using this method.

- GA/Broker type agencies with retail clients can be altered, however broker invoices cannot.

- Broker invoices in a retail agency cannot be altered using this method.

- Once a payment is attached to one of the GLs, that GL cannot be altered. (1120, 1130, 2110, 2120)

- Items in closed periods cannot be altered.

- Producer and Sub Producer are treated as one GL. Once the producer is paid, the sub-producer cannot be altered.

- All lines are locked together so a payment on a single invoice line locks that GL for all lines.

- Additional lines cannot be added.

Edit an Invoice With Items Attached

In addition to editing invoices using the methods below, there are many adjustment options also available.

![]() For more information regarding adjusting an invoice without editing the lines, see: Invoice: Adjust An Invoice and Invoice: Adjust Premium and Commission on Existing Invoices With Items Attached.

For more information regarding adjusting an invoice without editing the lines, see: Invoice: Adjust An Invoice and Invoice: Adjust Premium and Commission on Existing Invoices With Items Attached.

Identify the Attached Accounting Transactions

Attached accounting transactions can include:

- Client Payments

- Company Payments

- Producer Payments

- Journal Transactions

- Agency Fee Invoices or Open Item Matched (OIM) adjustment invoices.

Common attached accounting transactions can be viewed by opening each of the payment screens from Policy & Billing:

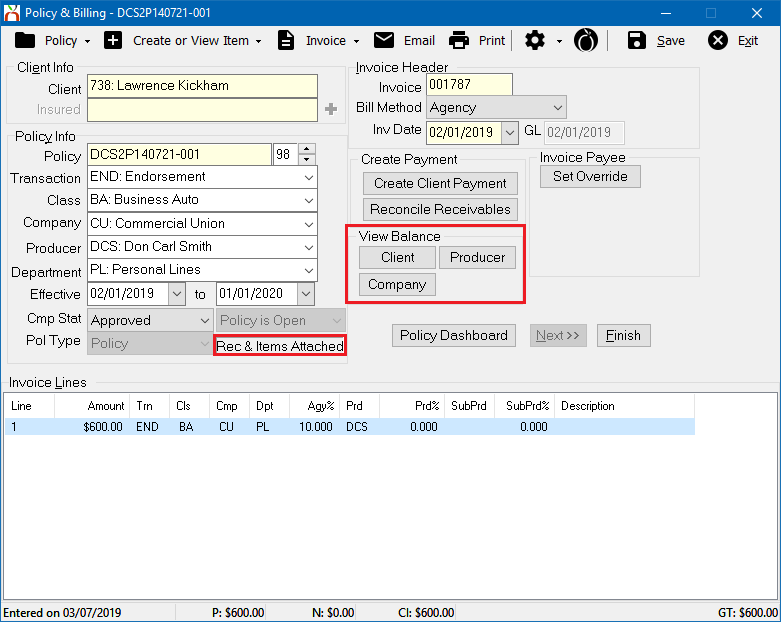

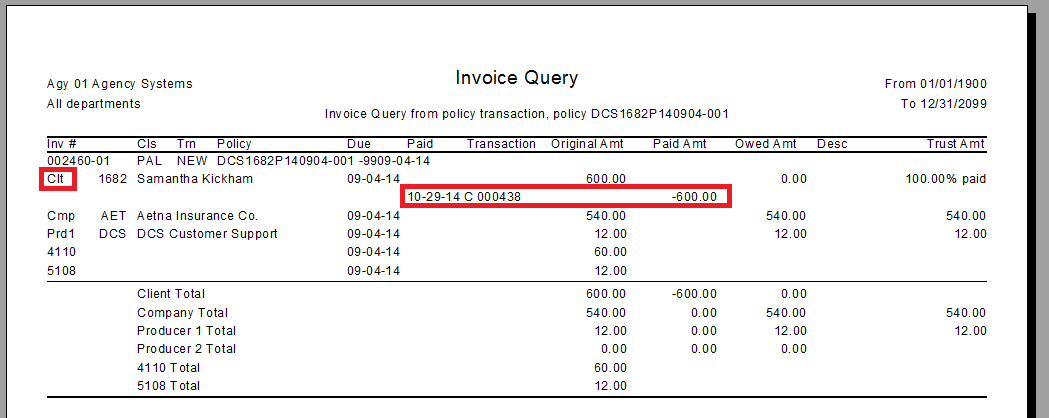

A complete list of accounting transactions can be produced by running an Invoice Query for the current invoice. From Policy & Billing, select Invoice-> Invoice Query. (From Example: One Client Payment (Cash) for $600.00).

Unapply the Attached Accounting Transactions

An invoice cannot be edited if the general ledger period is closed. See: Invoice: Adjust Premium and Commission on Existing Invoices in Closed GL Periods.

After identifying the attached accounting transactions, unapply the items using the steps below.

- Unapply Client Cash Payment From An Invoice

- Edit the Distributions on an Existing Check

- Unattach an Existing Journal Transaction from an Invoice

- Delete an Agency Fee Invoice

Once all items are unapplied, edit the invoice, or delete the invoice.