Difference between revisions of "Client Payment: Agency Bill Credit Card"

(→From the My Newton Campus Forum: Frequently Asked Questions: removed forum) |

|||

| Line 32: | Line 32: | ||

For instructions taking a payment on [[:Category:Direct Bill|direct bill policies]], see [[Client Payment: Direct Bill Cash Transmittal]]. | For instructions taking a payment on [[:Category:Direct Bill|direct bill policies]], see [[Client Payment: Direct Bill Cash Transmittal]]. | ||

| + | |||

| + | ==Frequently Asked Questions (FAQ)== | ||

| + | *[[Talk:Client_Payment:_Agency_Bill_Credit_Card#Client_credit_card_payment_-_Why_not_post_directly_to_bank_account.3F|Client credit card payment - Why not post directly to bank account?]] | ||

==Create a Credit Card Virtual Bank Profile == | ==Create a Credit Card Virtual Bank Profile == | ||

Revision as of 21:49, 30 November 2015

| Related Pages |

| Related Categories |

The process below is used when a client pays the agency using a credit card on an agency bill invoice, and the credit card company retains a fee for processing the payment.

For instructions taking a payment on direct bill policies, see Client Payment: Direct Bill Cash Transmittal.

Contents

Frequently Asked Questions (FAQ)

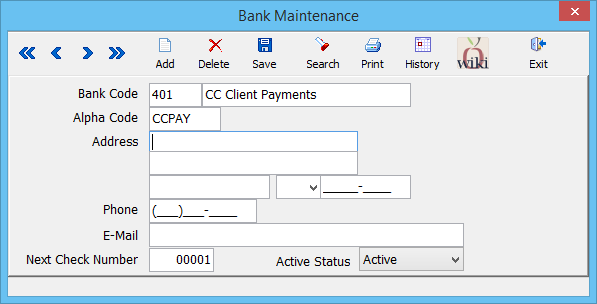

Create a Credit Card Virtual Bank Profile

A new virtual bank account will be used for all client credit card payments. This virtual bank account is a holding account until the money is physically deposited into the agency's premium trust bank account.

- Select Profiles -> Bank.

- Select Add.

- Enter a unique Bank Code. (Example: 401)

- Enter a Bank Name. (Example: CC Client Payments)

- Select Save -> Exit.

Create a Client Credit Card Payment - No Client Fees

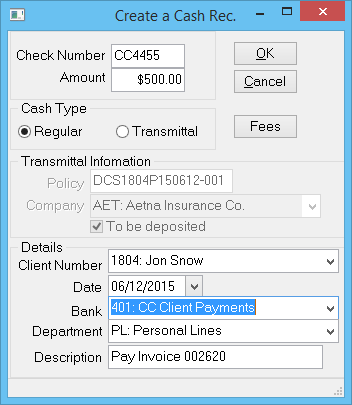

Example: The client makes a payment for $500.00 for an Agency Bill invoice. The credit card company charges the agency a $15.00 fee for processing, and deposits only $485.00 into the agency’s premium trust bank account.

- Create a client payment for the amount received. (From Example $500.00)

- Select Bank -> 401: CC Client Payments.

- Select OK.

Transfer Credit Card Payment - No Client Fees

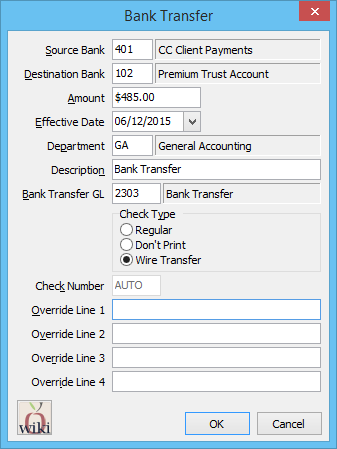

After the credit card processor transfers the money into the premium trust account, mirror the transaction in Agency Systems with the bank transfer wizard.

The transfer will be reduced by the amount of fees charged to agency by the credit card processor. The transfer amount can be a single payment, or the sum of multiple payments.

- Select GL -> Bank Transfer.

- Enter the Source Bank for the virtual credit card payments. (From Example: 401)

- Enter the Destination Bank for the premium trust account. (From Example: 102)

- Enter the Amount deposited. (From Example: $485.00)

- Confirm the remaining details and select Ok.

- The transfer between bank accounts will be processed and a confirmation displayed.

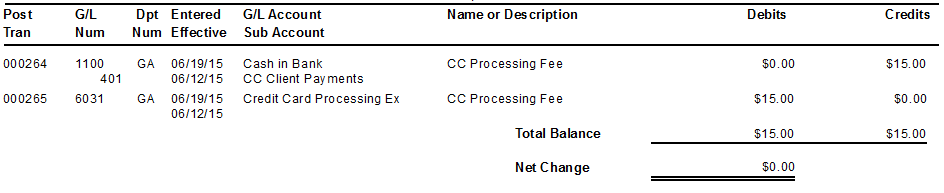

Create Expense Journal - No Client Fees

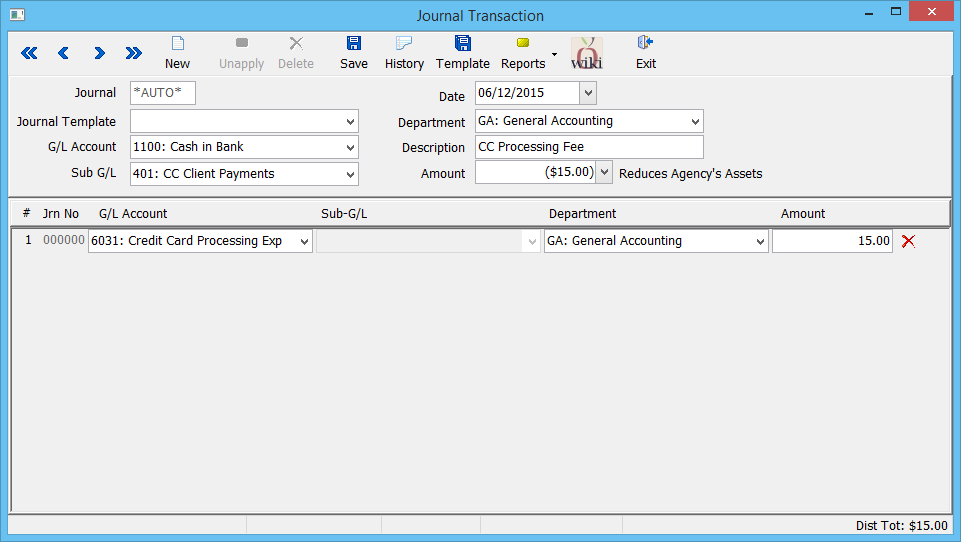

To move the sum of the credit card fees to the expense account, create journal transactions. For recurring journal entries, a journal template can be used. Click here for more information.

- Select GL -> Journal Transaction.

- Select New.

- Enter GL Account -> 1100: Cash in Bank.

- Enter the Sub GL Account. (From Example: 401)

- Enter the desired Date.

- Enter the Department, typically GA.

- Enter the Description.

- Enter the total Amount of the fees as a credit. (From Example: $-15.00)

- Enter the Expense GL Account as the first offset journal. (From Example: 6031: Credit Card Processing Exp)

- Enter the Department, typically GA.

- Enter the Amount of the fees as a debit. (From Example: $15.00)

- Select Save, then Exit.

Journal Register for fees: