Invoice: Adjust Producer Payable Commission for Expenses or Deductions

Jump to navigation

Jump to search

| Related Pages |

| Related Categories |

The procedure details the transactions required to adjust the Producer Payable (GL-2120) on either agency bill or direct bill invoices for non-invoiced reasons, such as cell phone expenses or health insurance premiums.

This process should only be used for one-time expenses, if the producer does not receive a recurring payroll check.

See: Producer Payables: Include Producer Commission in Payroll Check for recurring payroll entry including commission.

Find an Invoice for the Adjustment

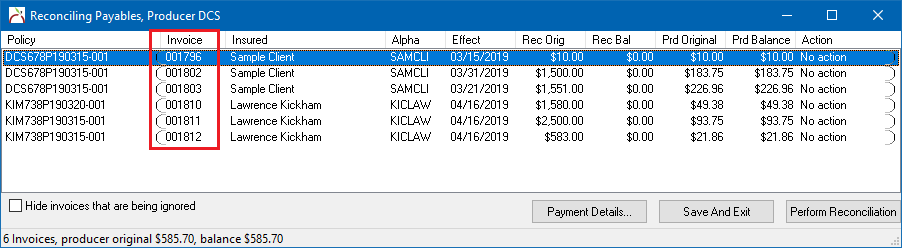

- Select Producer -> Reconcile Producer Payables.

- Enter the Producer's Code.

- Enter the desired Start Date and End Date for the invoices to be paid. Select OK.

- Write down any one of the listed invoice numbers which will be paid.

- Select the Red X to exit without saving or performing the reconciliation.

Adjust the Invoice

- Select Accounting -> Policy and Billing.

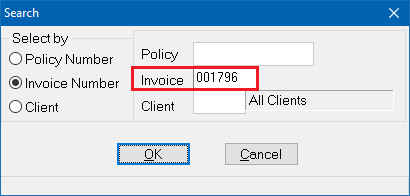

- Select Invoice -> Find Invoice.

- Enter the invoice number from above. Select Ok.

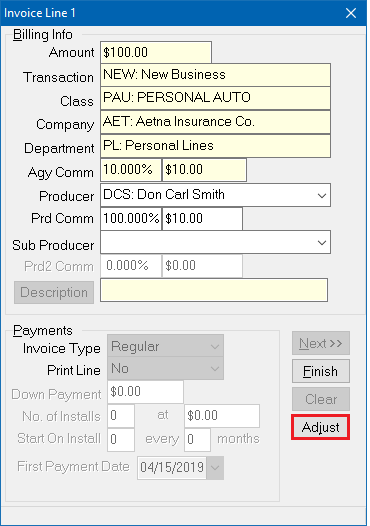

- Double-Click the first invoice line.

- Select Adjust.

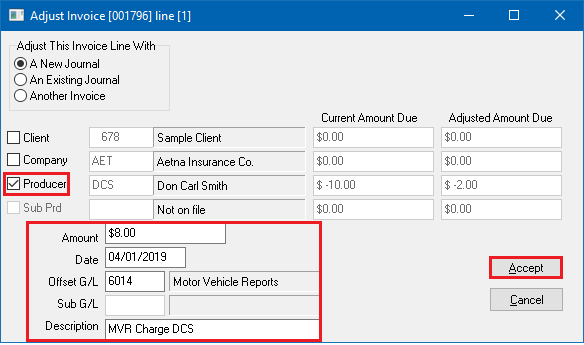

- Adjustment Details:

- Select Producer.

- Enter the Amount, and the Offset G/L. (To decrease the amount, enter as a debit. To increase the amount, enter as a credit (-).)

- Select Accept.

- Select Finish then Exit to close Policy & Billing.

Return to Reconcile Producer Payables and the amount due will now reflect the adjusted amount.