Difference between revisions of "Report: Cash Deposit Report"

m |

(→Cash Amt vs. Chk Amt: updated check # shortcuts) |

||

| Line 63: | Line 63: | ||

The Cash Deposit report lists [[:Category:Cash|cash transactions]] in one of two columns, '''Cash Amt''' or '''Chk Amt'''. The report determines which column to place the transaction in based on the data entered in the '''Check Number''' field on the cash transaction. | The Cash Deposit report lists [[:Category:Cash|cash transactions]] in one of two columns, '''Cash Amt''' or '''Chk Amt'''. The report determines which column to place the transaction in based on the data entered in the '''Check Number''' field on the cash transaction. | ||

| − | From [[Client Payment: Direct Bill Cash Transmittal]]: | + | From [[Client Payment: Direct Bill Cash Transmittal]]: Enter the client's '''Check Number''' or select '''F2''' for "<CASH>", '''F3''' for "<EFT>", or '''F4''' for "<CC>". ''(<EFT> and <CC> payments will be in the '''Chk Amt''' column on the report)''. |

:[[File:Payment-db-attachpay-createcash-2019.png]] | :[[File:Payment-db-attachpay-createcash-2019.png]] | ||

Latest revision as of 20:59, 14 March 2019

| Related Pages |

| Related Categories |

The Cash Deposit Report is a list of all Cash Transactions entered during the day. Any incoming money to the agency is referred to as Cash; physical checks, wire transfers (EFT), money orders, or physical cash.

Types Of Cash Receipts:

- Regular Cash: Agency Bill client and company payments, or money from any other general ledger account.

- Transmittal Cash: Direct Bill client payments which are forwarded in full to an insurance company.

- Non-Deposited Cash: Direct Bill transmittal cash payments that do not get deposited into the agency's bank account. (Example: A check written directly to the insurance company brought to the agency.)

Access and Window Options

The Cash Deposit Report can be opened by selecting Reports -> Cash Reports -> Cash Deposit Report. (The Cash Deposit Report is also available as one of the automatic daily reports.)

Access to the Cash Deposit Report is controlled through the security system A/R -> Cash Deposit Report -> View setting.

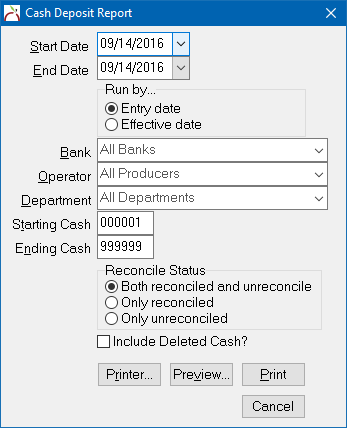

- Start Date and End Date: All items with a general ledger date within the selected range are included.

- Run by...: Changes the report to run by either Entry dates or Effective dates.

- Bank: Enter a Bank Code to limit the report to a single bank. By default, cash transactions entered to all banks are included, with sub-totals for each bank.

- Operator: Enter an Operator Code to limit the report to one entry operator. By default, cash transactions entered by all operators are included.

- Department: Enter a Department Code to limit the report to one department. By default, cash transactions entered with all department are included.

- Starting Cash and Ending Cash: Limit the report to a specific range of cash transactions. By default, all cash transactions are included.

- Reconcile Status: Limit the report to only reconciled or unreconciled cash. See Bank Reconcile and Bank Deposit for additional information.

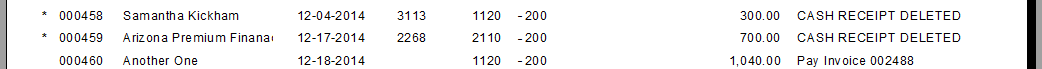

- Include Deleted Cash?: If selected, non-deposited cash transactions or items that have been deleted but not erased are included. By default, deleted items are ignored.

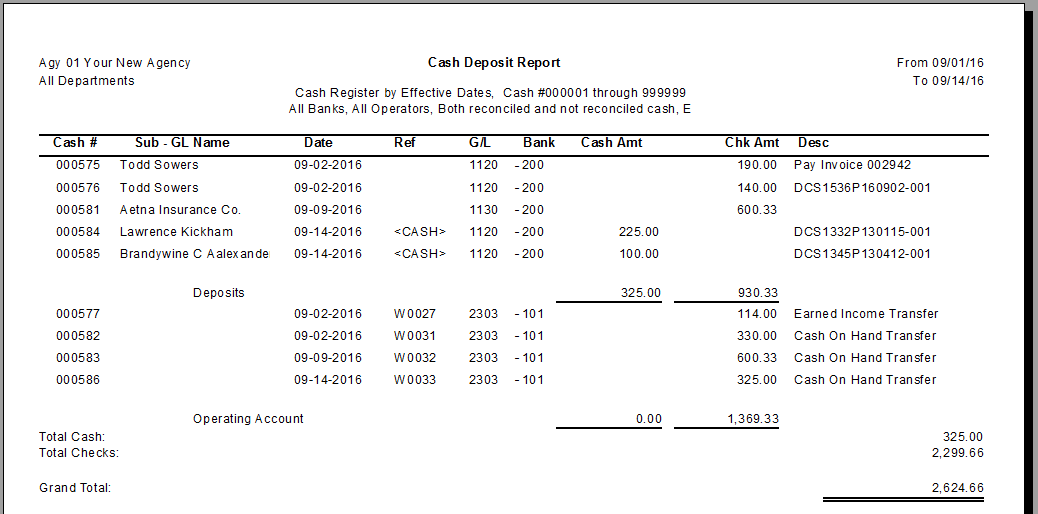

Report Example

Example below shows two bank accounts typically used in the Bank Deposit process.

Cash Amt vs. Chk Amt

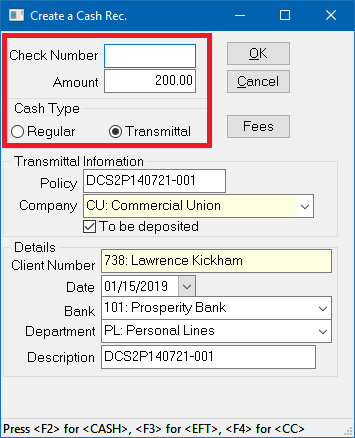

The Cash Deposit report lists cash transactions in one of two columns, Cash Amt or Chk Amt. The report determines which column to place the transaction in based on the data entered in the Check Number field on the cash transaction.

From Client Payment: Direct Bill Cash Transmittal: Enter the client's Check Number or select F2 for "<CASH>", F3 for "<EFT>", or F4 for "<CC>". (<EFT> and <CC> payments will be in the Chk Amt column on the report).