Difference between revisions of "Report: 1099s"

(added client profile 1099 link) |

|||

| Line 31: | Line 31: | ||

*The 1099 amounts for brokers (agents) are calculated from invoice transactions. | *The 1099 amounts for brokers (agents) are calculated from invoice transactions. | ||

| − | '''If you have manually entered 1099 totals on the [[Vendor Profile|vendor]] or broker (agent) profiles, the manually entered amount will display on the 1099 reports and forms instead of being calculated.''' | + | '''If you have manually entered 1099 totals on the [[Vendor Profile|vendor]] or [[Client_Profile#Client_Profile_1099_Information_Tab|broker (agent) profiles]], the manually entered amount will display on the 1099 reports and forms instead of being calculated.''' |

== Access and Window Options == | == Access and Window Options == | ||

Revision as of 13:20, 12 June 2015

| Related Pages |

| Related Categories |

Agency Systems has the capability to calculate 1099 amounts, then either print to the IRS 1099 laser forms, or create an electronic file for submission.

- The 1099 amounts reported for vendors are calculated from the check transactions coded to each vendor.

- The 1099 amounts for brokers (agents) are calculated from invoice transactions.

If you have manually entered 1099 totals on the vendor or broker (agent) profiles, the manually entered amount will display on the 1099 reports and forms instead of being calculated.

Access and Window Options

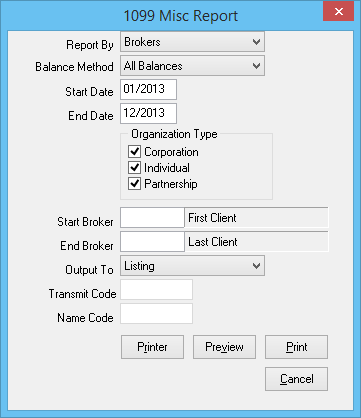

The 1099 report window can be opened by selecting A/P -> 1099-MISC Forms.

Access to the 1099 report is controlled through the security system A/P -> 1099-MISC Forms -> View setting.

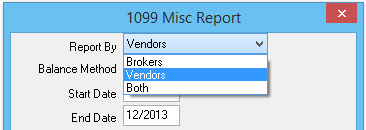

- Report By: Only Broker Clients, Only Vendors, or Both.

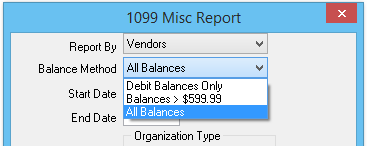

- Balance Method: Debit Balances Only, Balances > $599.99, or All Balances.

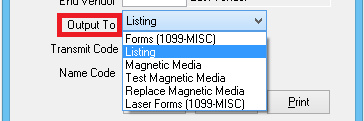

- Output: Listing, Forms (1099-MISC), Magnetic Media, Test Magnetic Media, Replace Magnetic Media, Laser Forms (1099-MISC)

Report Process

It is recommended to preview or print the 1099: Output -> Listing report first in order to:

- Verify the correct address and tax id information stored for the vendor and/or agent profiles.

- Verify the number of 1099 forms required. (1099 laser forms must be purchased at your local office supply store.)

After verifying the listing output and purchasing the 1099 forms, repeat the 1099 report and select Output -> Laser Forms (1099 MISC).

Each batch will only print a single page per entry. If you have 20 forms to print, first print all Copy A, then repeat the process and print Copy B.

- Select AP -> 1099-MISC Forms.

- Select Report By: Only Broker Clients, Only Vendors, or Both.

- Select Balance Method: Debit Balances Only, Balances > $599.99, or All Balances.

- Select the Start Date and End Date for the tax reporting period.

- Deselect any desired Organization Type.

- If desired, enter a start and end Vendor/Broker value to limit the results. (Only available if Report By is limited to a single type.)

- Select an Output:

- Forms (1099-MISC): One page per result, used with continuous feed paper printers (Legacy dot matrix printers).

- Listing: Summary for all Vendors/Brokers with totals for review.

- Magnetic Media: Exports a data file saved to \Empire\Programs\IRSTAX.001 for electronic submission.

- Test Magnetic Media: Exports a data file saved to \Empire\Programs\IRSTAX.001 for testing electronic submission.

- Replace Magnetic Media: Exports a data file saved to \Empire\Programs\IRSTAX.001 for electronic submission to update an existing submission.

- Laser Forms (1099-MISC): One page per result, used with modern laser or inkjet printers.

- Enter the Transmit Code and Name code, only when selecting Output -> Magnetic Media.

- Select Print.