Process Daily Cash Deposits With Cash On-Hand Account

| Related Pages |

| Related Categories |

Any cash and check transactions received in person are entered into a cash on-hand bank account. The bank account represents any money received by the agency that has not been deposited at the bank. Any electronic funds (EFT) are automatically posted directly to the operating bank account.

This procedure outlines the day-to-day process of accepting cash and check transactions, and creating a single daily deposit in Newton. The single daily deposits will match the amounts shown on your monthly bank statement.

- Any incoming financial transactions in Newton are referred to as cash.

- Any outgoing transactions are referred to as checks.

- Electronically received cash is referred to as EFT cash, and electronically transferred checks are referred to as wire checks.

Contents

Frequently Asked Questions (FAQ)

Create A New Default Cash Bank Profile

For the example, bank profile code: 200 - Cash On-Hand will be used for all physical cash/check transactions. This bank account is a holding account until the money is physically deposited into the operating account. This account will always reflect the actual amount of money on-site waiting to be deposited.

Bank account code: 101 represents the default operating account at the bank.

Create A New Bank Profile

- Select Setup -> Bank.

- Select Create New.

- Enter a unique code (From Example: 200).

- Enter a name. (From Example: Cash On-Hand).

- Select Save -> Exit.

Set The Default Cash Bank Code

- Select Setup -> Agency.

- Select Find to load your agency profile if different than 01.

- Select the Accounting Setups tab.

- Enter the new bank code for Default Bank for... -> Cash Transactions. (From example: 200).

- Select Save -> Exit.

The Commission Download system has a different set of options for the default cash and check bank profiles. (See: Company -> Download -> Options -> Commission tab)

Enter Daily Transactions

Daily transactions are entered as EFT transactions, or transactions that must be physically brought to the bank.

Enter Daily Physical Cash and Check Transactions

When physical cash or checks are received in the mail or in person, deposit the payment as cash into the default bank. (From example: 200).

For Direct Bill policy sweep payments (Transmittal), deposit the cash into the default bank. (From example: 200). When prompted, create the offset check to the default operating account (From example: 101).

Enter Daily EFT Cash and Check Transactions

When an EFT transaction is posted to your bank account, such as a direct bill commission payment, deposit the cash receipt into the operating account (From example: 101).

- Remember to change the default bank code to 101 when entering the transaction(s).

Create Bank Deposit

A new bank deposit wizard is now available to automate the daily cash deposit process. The Bank Deposit Wizard will do the following:

- Display all unreconciled cash transactions saved to the cash on-hand bank account in Newton which have not been transferred to the operating account.

- Allow the operator to select the desired items to transfer to the operating account as a deposit.

- Create the transfer of money to the operating account as a single deposit (cash transaction).

- Automatically reconcile the transferred cash on-hand transactions.

- Print a report showing only the items transferred from the cash on-hand account, to the operating account.

Access to Accounting -> Bank Deposit requires the following security levels: (Other -> Security System)

- AR -> Cash Transaction -> View, Entry, Edit

- AP -> Check Transaction -> Entry

Using the Bank Deposit Wizard

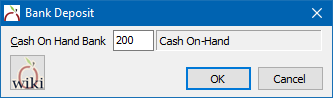

- Select Accounting -> Bank Deposit.

- Enter the cash on-hand Bank Code.

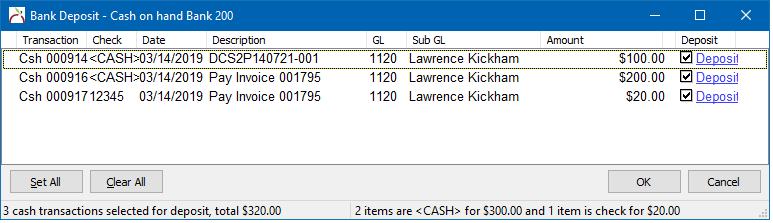

- Select Ok. All unreconciled cash items will be displayed, pre-selected for transfer. The total deposit amount is displayed at the bottom.

- Select Set All or Clear All to selected/deselect all items. Alternatively, individual items can be selected or deselected using the Deposit check box.

- After all of the desired transactions have been selected, Select Ok.

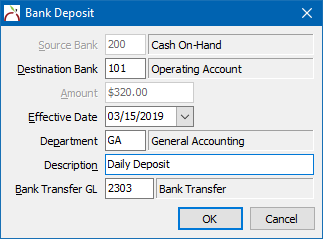

- The bank deposit transfer window will display.

- If desired, edit the Effective Date, Department Code, Description, or Bank Transfer GL. Select Ok when finished.

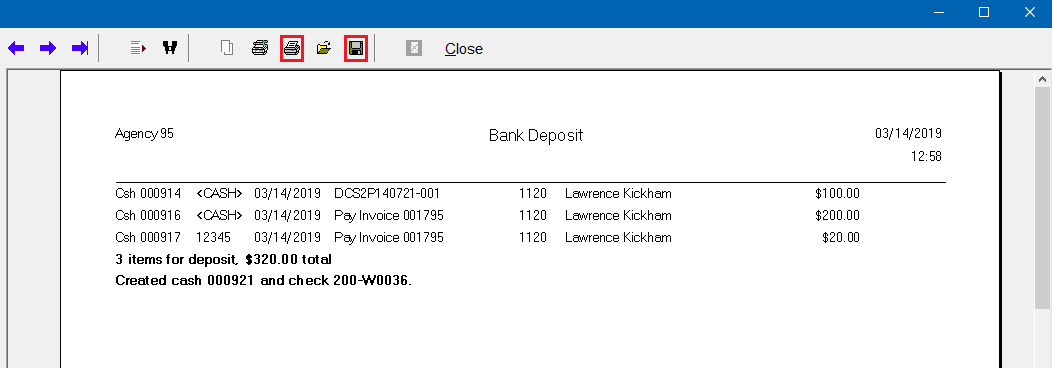

- The deposit report will be displayed, listing all transferred transactions and the deposit total. Print or Save the report as desired. In addition, an archive .PDF of each Bank Deposit report is automatically saved in the \Empire\Reconciles directory.

Reconcile and Audit Bank Deposits

Reconcile Monthly Bank Deposits

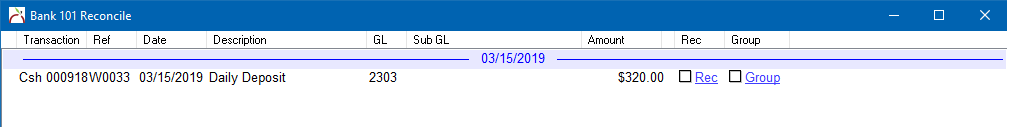

During your monthly reconcile, the bank deposits will display as a single daily transaction. The single transaction will match the amount displayed on the bank statement for use during the bank reconcile process.

EFT transactions will show as individual items.

Audit Bank Deposits

If an individual transaction is ever deleted or altered by an authorized user, a daily cash deposit report can be used to quickly identify which day has changed.

The cash on-hand bank profile (From example: 200) should never retain a daily balance. The balance sheet will quickly display a procedural error.