Agency Bill: Adjust Client Receivable - Write Off Small Balance or Bad Debt

(Redirected from Small Balance Write Off)

Jump to navigation

Jump to search

| Related Pages |

| Related Categories |

The procedure details the transactions required to adjust the Agency Bill client accounts receivable (GL 1120) when an invoice transaction still has a small balance after posting cash received, or maybe it has been determined the balance is noncollectable.

In either case, the remaining amount can be written off as an expense in the general ledger.

Frequently Asked Questions (FAQ)

Adjust the Invoice

- Load a client on one of the client tabs.

- Select the Accounting tab.

- Double-Click on the invoice number showing a balance to show all invoice details.

- Left-Click on any of the invoice lines to open the invoice in Policy & Billing.

- Double-Click on the invoice line with the balance that will be written off. (If the invoice has multiple lines, and each line has an amount to write off, the steps below will need to be completed for each line.)

- Select the Adjust button in the lower right-hand corner of the screen.

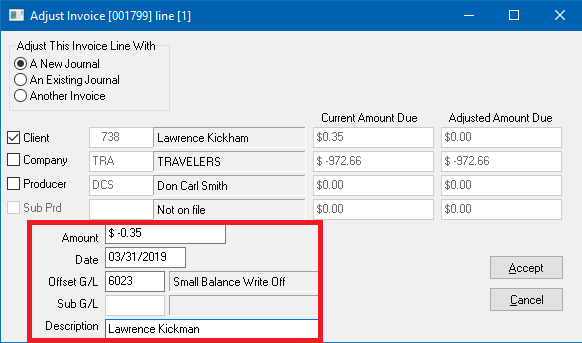

- Verify Adjust This Invoice Line With: A New Journal is selected.

- Enter the the adjustment in the Amount field as a credit (-). (Example: Account tab shows the amount due as $.35; Enter $-.35 as the adjustment.)

- Select Tab to the Offset GL field and enter the desired Expense account. (Example: 6023 - Small Balance write off or 6024 - Bad debt.)

- Enter a Description.

- Select Accept then Finish close the invoice line details.