Difference between revisions of "Producer Payables: Include Producer Commission in Payroll Check"

m (→Create a New Bank Profile: typo) |

|||

| Line 40: | Line 40: | ||

[[Non-Policy_Related_Checks#Employee_Salary_Payroll_Check_Template|Create and store payroll check template for each vendor code created above]]. | [[Non-Policy_Related_Checks#Employee_Salary_Payroll_Check_Template|Create and store payroll check template for each vendor code created above]]. | ||

| − | In addition to the payroll distributions, include an ''' | + | In addition to the payroll distributions, include an '''additional distribution: GL 1100 sub GL 999 for 0.00'''. |

:[[File:Ap-nonpol-payroll-add999.png]] | :[[File:Ap-nonpol-payroll-add999.png]] | ||

Revision as of 19:35, 21 October 2014

| Related Pages |

| Related Categories |

The process below outlines all steps required to include producer commission on an employee payroll check, including any non-policy related general ledger deductions.

Contents

One-Time Setup

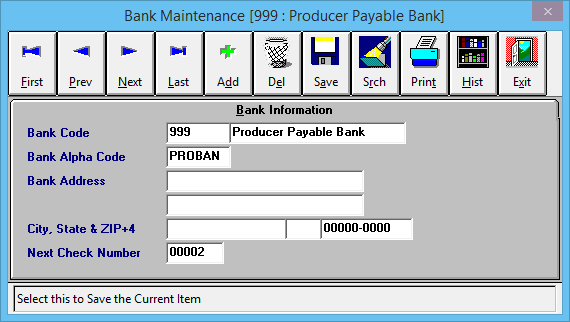

Create a New Bank Profile

Create a new Bank Profile, number 999, named Producer Payable Bank. (Any bank code can be used, other than the operating and trust accounts).

Create a Vendor Profile For Each Producer

Create a Vendor Code for each Producer.

Create an Employee Payroll Check Template For Each Vendor

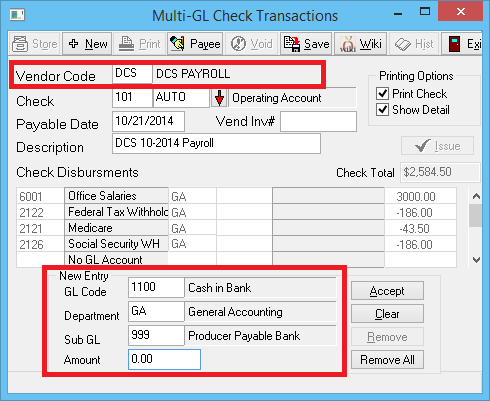

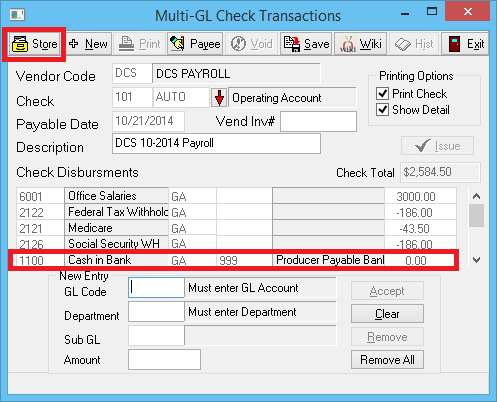

Create and store payroll check template for each vendor code created above.

In addition to the payroll distributions, include an additional distribution: GL 1100 sub GL 999 for 0.00.

After selecting Accept, verify the distribution is added to the list, and select Store.

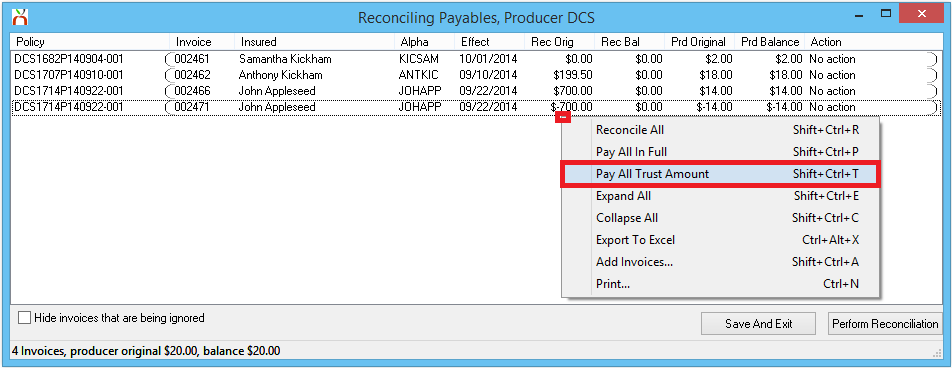

Part 1: Clear Producer Payables Using Reconcile Producer Payables

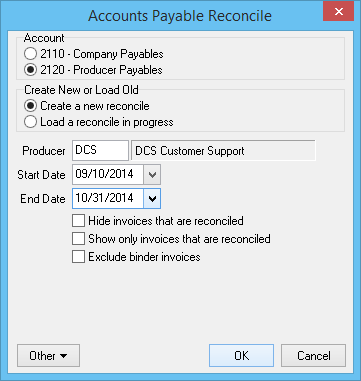

The first part clears the Producer Payables balance (GL-2120) on invoices and records the wire check to bank 999.

- Select AP -> Reconcile Payables.

- Select Producer Payables.

- Enter the Producer's Code.

- Enter the desired Start Date and End Date for the invoices to be paid. Select OK.

- Right Click -> Pay All Trust Amount to pay all invoices listed, or select individual invoices to Pay this Invoice Trust Amount.

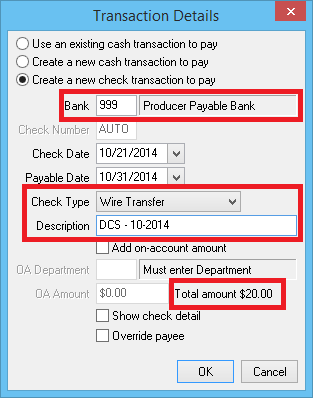

- Select the Payment Details button at the bottom of the screen.

- Change Bank Code to 999.

- Change Check Type -> Wire Check.

- Enter a Description.

- Write down Total Amount shown on the bottom-right corner of this window. This amount will be needed for the payroll check. Select OK.

- Select Perform Reconciliation.

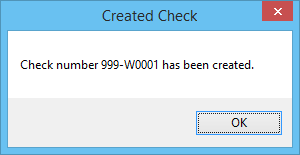

- The system will display "Check Number 999-WXXXX has been created.". Select OK.

- The system will display "Reconciliation complete". Select OK.

See: Reconcile Producer Payables for more details.

Part 2: Include Producer Payables Commission on Employee Payroll Check

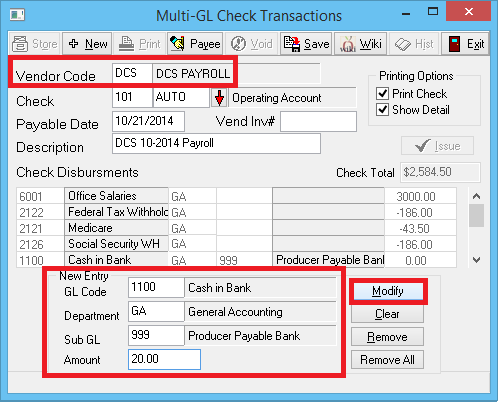

The second part will create a non-policy related payroll check using the vendor code and employee payroll check template created in the one-time setup above.

- Select AP -> Check Transaction -> Non-Policy Related.

- Enter the Vendor Code for the producer. (The previously stored check template details will load.)

- Enter GL code 1100, Department GA, and Sub GL 999. Enter reconcile payable amount from Part 1. Select Modify.

- Continue to Modify GL distributions on the template until the check total equals the amount of the employee's payroll check. To edit an existing Check Disbursement Amount, enter the matching GL Code and Department. Enter the new Amount, and select Modify.

- When finished, select Save.