General Ledger Profile

| Related Pages |

| Related Categories |

The General Ledger Profile screen is a list of General Ledger codes available when entering accounting transactions including:

- Cash, Check, and Journal Transactions

- Vouchers and Non-Policy Related Multi-GL Checks (legacy)

- Invoice Transactions

- Balance Sheet and Income & Expense reporting

Contents

Frequently Asked Questions (FAQ)

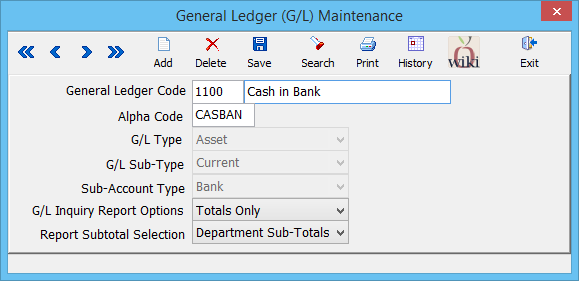

General Ledger Profile Screen

Select Profiles -> General Ledger. (Requires Security System: Profiles -> General Ledger -> View)

General Ledger Profile Menu Options

- Add - Create a new General Ledger Profile

- Search - Load an existing General Ledger Profile

- Print - Print a short summary of all General Ledger Profiles (Chart of Accounts). A spreadsheet for the full chart of accounts can also be exported.

- Exit - Close the window. You will be prompted to save if you have changed the General Ledger Profile.

General Ledger Profile Fields

G/L Inquiry Report Options:

- Totals Only - Total for all type of transactions

- Monthly Totals - Breaks down totals by month

- All Details - Breaks down detail for all transactions

Report Subtotals Selection:

- Department Subtotals - Breaks down the detail by department

- No Subtotals - Does not break down the detail by department

| G/L Type | G/L Code | G/L Settings |

|---|---|---|

| Asset | 1100 - 1999 | Current, Fixed, Other |

| Liability | 2000 - 2299 | Current, Long-Term, Other |

| Capital | 2300 - 2999 | No Sub-Types |

| Income | 4100 - 4999 | Operating, Miscellaneous |

| Expense | 5000 - 6999 | Administrative, Sales, Other |

Required General Ledger Accounts

Agency Systems requires certain General Ledger accounts to be setup in order for the accounting transactions to post properly. The accounts are pre-configured, and should not be edited.

Asset Accounts

1100 - Cash in Bank: This account is used to post Cash and Check transactions in Agency Systems. General Ledger 1100 is used when a new bank is setup in Agency Systems. It is setup as a Current Asset with Bank Sub Accounts defined.

1120 - Client Accounts Receivable: Each client/agent setup in Agency Systems is assigned a client number under 1120. This account is reflected when a client makes a payment, a check for returned premium, and all types of invoices created in Agency Systems. This account is setup as a Current Asset with Client Sub Accounts defined.

1130 - Company Accounts Receivables: This account is normally used when Direct Billed invoices are created. When posting the check received from the Insurance Carrier, the cash receipt is posted to the 1130 account. This account is setup as a Current Asset with Company Sub Accounts defined.

Liability Accounts

2110 - Company Accounts Current Payable: Agency Billed invoices are posted to this account. The check to the Insurance Company is cut to this account when you post the check less your Agency Commission. This account is setup as a Current Liability with Company Sub Accounts defined.

2120 - Producer Commission Payable: On all invoice transactions, the 2120 account is reflected by the Producer Commission amount on an invoice. Producer Statements can be produced for all commission based producers in your agency. This account is setup as a Current Liability with Producer Sub Accounts defined.

2130 - Vendor Payable: Vendors setup under the Profiles menu can have non policy related checks created in the system. A Check Register can be run for a particular vendor code based off this account. This account is setup as a Current Liability account with Company Sub Accounts defined and Use as Vendor selected.

Capital Accounts

2303 - Bank Transfer: See Bank Transfer for details and setup instructions. (The GL number can be changed as desired.)

2318 - Retained Earnings: Automatically calculated and displayed on the Balance Sheet based off the the previous fiscal year's ending Profit or Loss amount.

2319 - Profit or Loss: Automatically calculated based off the Income & Expense total and displayed on the Balance Sheet.

- The assigned General Ledger code for the Retained Earnings and Profit or Loss capital accounts can be reconfigured in the Agency Profile -> Accounting Setups tab.

Operating Income Accounts

4110 - Agency Billed Commission Income: All invoices entered into Agency Systems of type Agency Billed will post to this account. The Income and Expense Report will show the amount of Agency Billed income for a specified period of time. This account is setup as an Operating Income account setup with no sub accounts defined.

4120 - Direct Billed Agency Commission: All invoices entered into Agency Systems of type Direct Billed will post to this account. The Income and Expense Report will show the amount of Direct Billed income for a specified period of time. This account is setup as an Operating Income account with no sub accounts defined.

Operating Expense Accounts

5108 - Commission Expense: Agency and Direct billed invoices are posted to this account. An Income and Expense report will show this amount for a specified date range. This account is setup as a Sales Expense with no sub Accounts setup.

5109 - Commission Expense: Broker billed invoices are posted to this account. An Income and Expense report will show this amount for a specified date range. This account is setup as a Sales Expense with no sub Accounts setup.