Difference between revisions of "Credit Card Processing For Expense Entry"

(added video) |

|||

| Line 36: | Line 36: | ||

*Reports can be completed for total expense based on type, or total expense per vendor. | *Reports can be completed for total expense based on type, or total expense per vendor. | ||

*Credit Card statements can be reconciled in Newton using [[Bank Reconcile]]. | *Credit Card statements can be reconciled in Newton using [[Bank Reconcile]]. | ||

| + | |||

| + | ''(Alternatively, if individual transactions for each expense are not desired, and reports by vendor are not needed, a single [[Non-Policy Related Checks|non-policy related check]] can be created with each expense general ledger account entered as a monthly total.)'' | ||

== Create a New Credit Card Bank Profile == | == Create a New Credit Card Bank Profile == | ||

Revision as of 13:57, 6 August 2014

| Related Pages |

| Related Categories |

All non-policy related expense transactions are recorded as wire or regular checks using the Non-Policy Related Checks interface.

The interface supports multiple General Ledger Profile expense entries per transaction. The checks are all recorded under GL 2130: Vendor Payables. When a transaction is recorded, the debit is recorded against the entered Bank Profile, which can be a bank account, or an alternate bank account such as a credit card.

This procedure outlines the day-to-day process of recording expense entries using a credit card, and posting a credit card payment against the balance.

- Each expense transaction is recorded individually, to the appropriate vendor (Electronic Store, Utility Company, Grocery Store etc).

- Entries can be recorded immediately instead of as a lump sum at the end of the month.

- The current credit card balance can be viewed from the Balance Sheet.

- Reports can be completed for total expense based on type, or total expense per vendor.

- Credit Card statements can be reconciled in Newton using Bank Reconcile.

(Alternatively, if individual transactions for each expense are not desired, and reports by vendor are not needed, a single non-policy related check can be created with each expense general ledger account entered as a monthly total.)

Contents

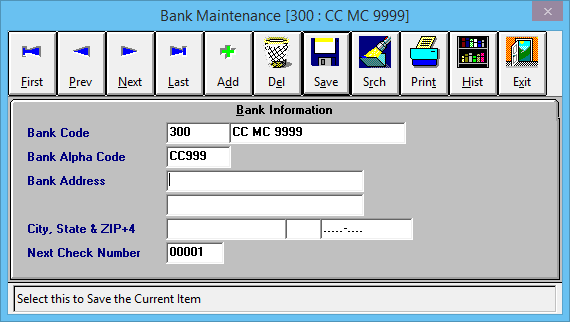

Create a New Credit Card Bank Profile

All expenses will be recorded to a dedicated Bank Profile, which represents a credit card balance.

- Select Profiles -> Bank.

- Select Add.

- Enter a unique code (From Example: 300).

- Enter a name. (From Example: CC MC 9999).

- Select Save -> Exit.

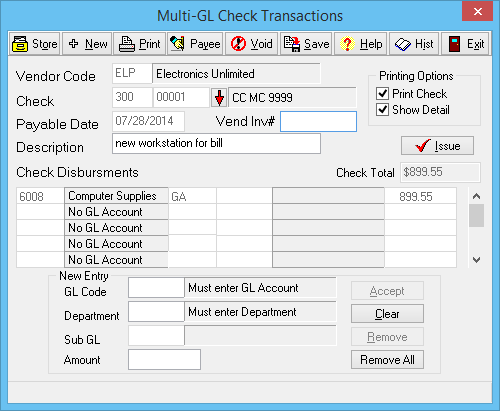

Create Expense Entry Charged to Credit Card

For more information regarding vendor payables, see Non-Policy Related Checks.

- Select AP -> Check Transaction -> Non-Policy Related.

- Enter the Vendor Code.

- Enter the credit card Bank Code. (From Example: 300)

- Enter the Payable Date.

- Enter a short Description.

- Enter the GL Code for the expense.

- Enter the Department Code.

- Enter the Sub GL if necessary.

- Enter the Amount.

- Select Accept.

- Repeat steps 6-10 until all GL entries are listed.

- When finished, select Save, then Exit.

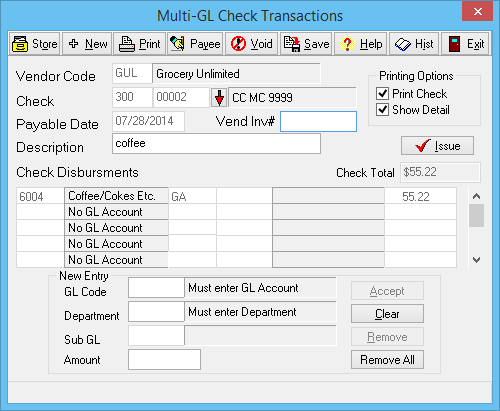

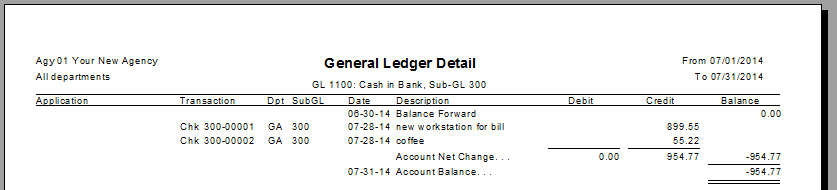

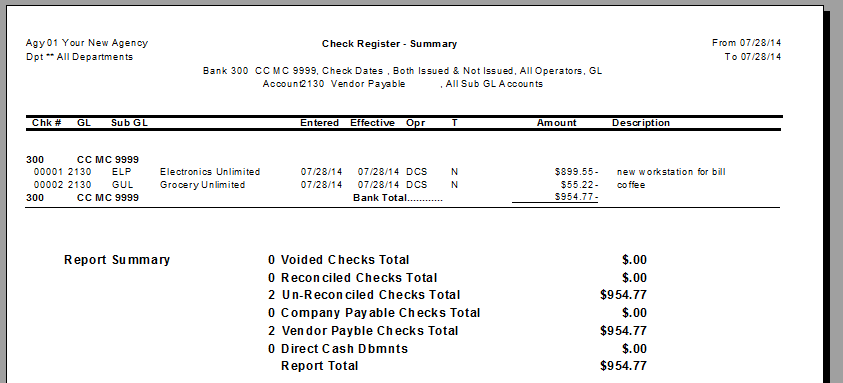

Example: Two Vendor Payable Transactions

Enter additional checks for each expense charged to the credit card.

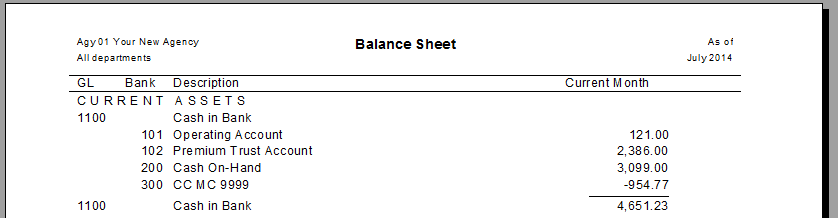

View Credit Card Balance

The expense entries will be automatically posted to the system General Ledger, and available on a number of reports.

View Balance Sheet Entries

All bank codes are displayed under GL 1100, including the current credit card balance.

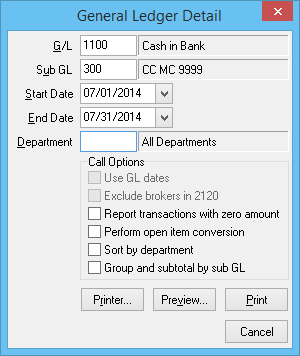

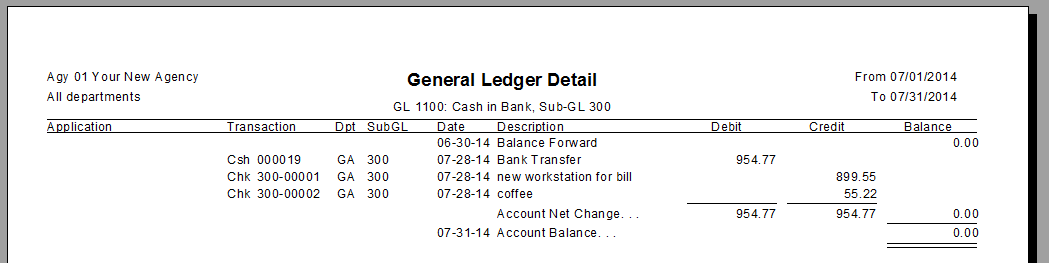

View GL Detail Entries

GL -> General Ledger Detail for GL 1100 SubType 300 displays all transactions for the specified period.

View Income & Expense Entries

GL -> Income & Expense displays the totals entered for each expense GL.

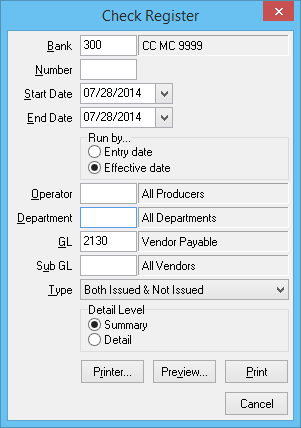

View Vendor Payable Entries

AP -> Check Reports -> Check Register displays the totals entered for all vendors, or for a specific vendor if a Sub GL is used.

Pay Credit Card Balance with Bank Transfer

See Bank Transfer for setup and additional instructions.

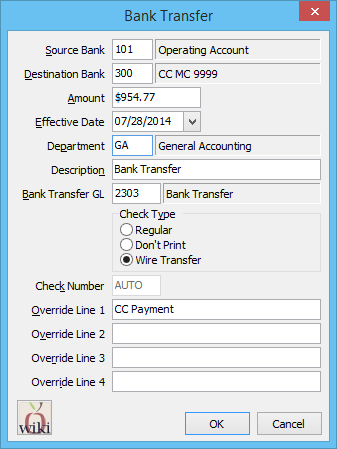

- Select GL -> Bank Transfer.

- Enter the Source Bank Code.

- Enter the Destination Bank Code for the credit card. (From Example: 300)

- Enter the Payment Amount.

- Confirm the remaining details and select Ok.

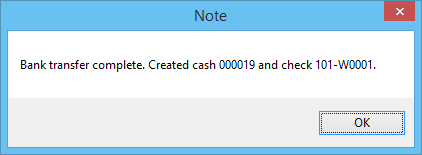

- The transfer between bank accounts will be processed and a confirmation displayed.

When finished, a GL Detail Report will display the transfer, adjusting the bank balance.