Client Refund on Overpayment or Credit Balance

| Related Pages |

| Related Categories |

Use the procedure below when you have received a cash payment over the amount of the invoiced items, and you wish to create a check for the overpaid amount. The process will apply the extra cash to the invoice, and create a refund check to the client/agent.

If the refund check is due to a cancellation or credit endorsement, see: Create and Process Return Premium Invoice Due to Cancellation or Endorsement.

If the refund check will be placed on account, and not applied to an invoice, see: Create Client Refund Check - On Account (Optional).

Contents

Overapply On-Account Cash to an Invoice

To skip this step and place the refund amount on account, see Create Client Refund Check - On Account (Optional) below.

- Load a client on one of the client tabs.

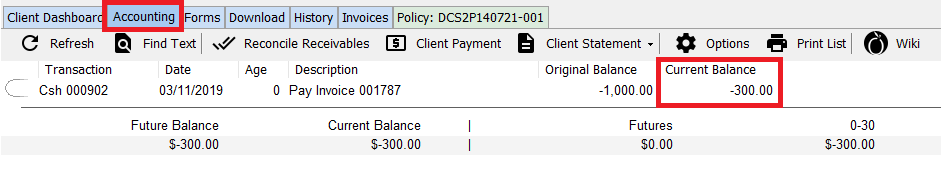

- Select the Accounting tab.

- Double-Click to expand the Cash Receipt. (If the invoice viewed from the client's account tab already shows the credit balance, skip to creating the client refund check.)

- Left-Click the Cash Receipt number.

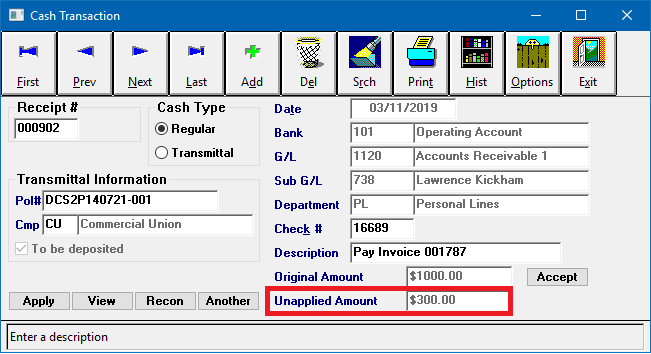

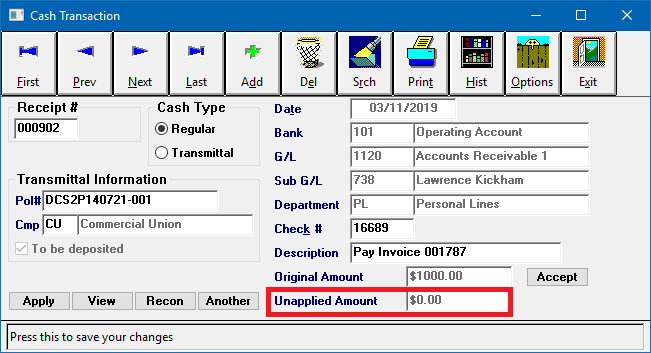

- Note the total Unapplied Amount of the Cash Receipt.

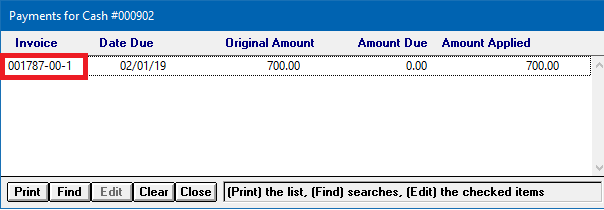

- Select View and Left-Click any one of the invoices listed that the cash item is already paying.

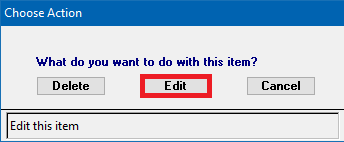

- When the Choose Action box appears select Edit.

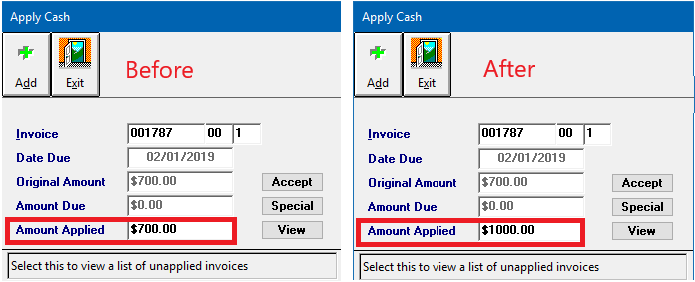

- <TAB> to the Amount Applied field and enter the new Combined Amount.

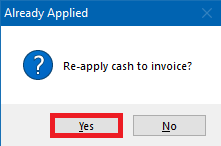

- Select Accept. Answer Yes to Re-apply Cash to invoice.

- Select Exit then Close.

- The unapplied amount for the cash transaction should now be zero.

- Exit the cash transaction screen and refresh the account tab. The credit will now be applied to the invoice.

Create Client Refund Check

A client refund check to GL-1120 will be created through Reconcile Client Receivables.

- Load a client on one of the client tabs.

- Select the Accounting tab. The return premium invoice will be listed with a credit balance.

- Select Reconcile Receivables on the top toolbar.

- Verify the date range includes the overapplied premium invoice.

- Deselect Create or use existing cash transaction since we will be creating a check transaction.

- Select Ok.

- Right-Click on the invoice, and select Pay This Invoice In Full.

- Select Payment Details at the bottom of the reconcile window.

- Change the action to Create A New Check Transaction To Pay.

- Enter the details for the check transaction, and select Ok.

- Select Perform Reconciliation to create the check and pay the client balance.

Create Client Refund Check - On Account (Optional)

A client refund check to GL-1120 can also be created through Express Checks. The Express Checks interface allows the operator to place the refund amount on account, without needing to apply the balance to a specific invoice.

- Load a client on one of the client tabs.

- Make a note of the client number in the client drop-down box.

- Select Accounting -> Express Checks.

- Enter the Bank Code for the check.

- Change the check type from Regular to Wire or Don't Print if desired.

- Select the Date for the check.

- Enter the GL 1120 by keying the code, or selecting the drop-down.

- Enter the Sub GL as the client number noted above.

- Enter a short Description.

- Select the Manual button within the toolbar at the middle of the window. .

- Change Apply To -> On-Account.

- Select the Department Code.

- Enter the Amount.

- Select Ok.

- To add additional department distributions, repeat the steps above. When finished, select Cancel.

- The check is now complete.

- Select Print to print the check, then Exit when finished.

See: Express Checks: Create an On-Account Check for additional details.