Beginning Balances

| Related Pages |

| Related Categories |

Your general ledger beginning balances in Newton are made up of several journal entry transactions representing the ending balances for these accounts in your previous systems general ledger.

These balances are obtained from the last months closing reports of your previous system. If you are starting the Newton accounting at the beginning for your fiscal year you will not be required to enter balances for the Income and Expense general ledger accounts.

The beginning balance entries are not required to start entering live data in Newton, however, without these balances, the financial reports in Agency System will not be accurate. We recommend you bring your current systems balances into Newton as shown within this document and make any necessary adjustments to the balances in Newton.

Contents

Steps to Create Beginning Balance GL Entries

- Determine your ending balances in your previous system. (Balance Sheet, Income & Expense, Aged Receivables, etc.)

- Consult with your CPA to make sure the balances are what you want.

- Set up the Chart of Accounts in Newton.

- Newton Support will contact you to create the beginning balance spreadsheet, pre-filled with your Chart of Accounts. (If you are receiving a data conversion, this will occur after your live date.)

- Enter your balances into the spreadsheet, adding additional rows for each General Ledger account with multiple Sug GL entries. (Example: 2110 - Company payable. One row/line for each company.)

- Create any missing profiles for sub-accounts such as companies, producers, vendors, banks, and clients.

- Return the completed spreadsheet to support.

- The data will be reviewed for errors, then loaded into your data set.

- Newton support will review your balances with your agency if the result is out of balance.

Enter Balances into the Beginning Balance Spreadsheet

Note: The spreadsheet created by support must be used. You cannot submit your own custom spreadsheet for use with beginning balances.

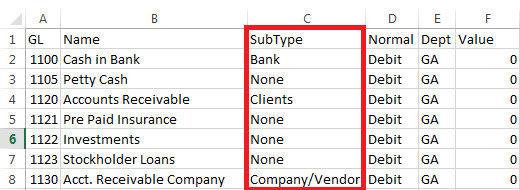

The spreadsheet will contain 5 columns for each row:

- A - GL Account Number

- B - GL Account Name

- C - GL Account SubType

- D - Normal amount is either Debit/Credit

- E - Department Code for beginning balance entry.

- F - Amount of BB. (Entered as a debit or credit; 200.00 vs -200.00)

Enter the General Ledger SubType

The SubType column (C) indicates whether a SubGL must be entered. If SubType = None, skip the column and enter the Value.

If required, replace the SubType Text with the appropriate Sub GL.

For Example GL 1100 - SubType Bank GL 1120 - SubType Client GL 2110 - SubType Company/Vendor Replaced With: GL 1000 - SubType 101 (Bank Code) GL 1120 - SubType 39833 (Client Number) GL 2110 - SubType TRA (Travelers Company Code)

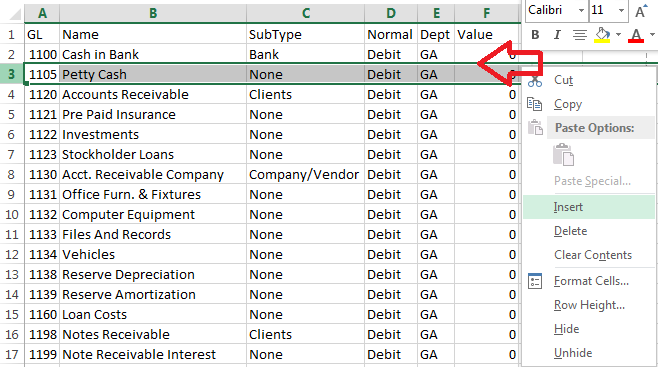

Create Multiple Entries for the same General Ledger Account

General Ledger Accounts with SubTypes may require multiple entries for each Sub GL.

For Example GL 1100 - SubType 101 (Bank Code - Operating Account) GL 1100 - SubType 102 (Bank Code - Premium Trust Account) GL 1120 - SubType 113 (Client Code) GL 1120 - SubType 12344 (Client Code)

To insert a new row, Right-Click the row below the entry point and select Insert. (From Example: Right-Click on row 3, to insert a new row between row 2 and row 3.)

How Are the Beginning Balance Entries Recorded?

For the non-invoice accounts, a Journal will be set up on the posting date, in the values listed.

For accounts 1120 (Client Receivable), 1130 (Company Receivable), 2110 (Company Payable), and 2120 (Producer Payable), an invoice will be attached to a dummy policy with a single beginning balance journal attached.

Beginning balance invoices can be paid in full, or in part through Reconcile Receivables, and Reconcile Payables.