Bank Reconcile

| Related Pages |

| Related Categories |

The Newton Bank Reconciliation feature allows you to verify the transactions in your bank accounts against the transactions recorded in Newton. The reconciliation feature itself is straightforward: You can load all transactions within a date range (e.g. a given month), compare the total with your bank statement total for that period, and reconcile the lot as a batch.

Daily cash deposits will be listed as a single cash receipt, instead of a list of individual payments, matching the daily deposit from the bank statement.

Contents

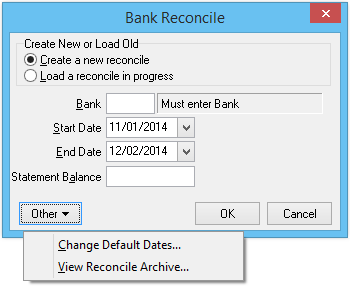

Bank Reconcile Screen

Select GL -> Bank Reconcile. (Requires Security System: GL -> Bank Reconcile -> View, Entry, and Edit)

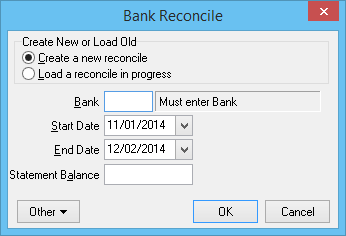

Bank Reconcile Fields

- Create a new reconcile: Begins the process of starting a new bank reconcile.

- Load a reconcile in progress: Resumes a saved bank reconcile in progress.

- Bank: The Bank Profile used for the bank reconciliation.

- Start Date: The start date for all transactions. Any transaction prior to the start date will be automatically included in the reconciled bank balance.

- It is recommended to set to the start date to the day the agency began using Agency Systems. (See Change Default Dates to configure the default value.)

- End Date: The end date for all transactions. Any transaction after the end date will not be included in the bank reconcile. (See Change Default Dates to configure the default value.)

- Statement Balance: The statement balance provided by the bank, as of the End Date.

Create A New Bank Reconcile

The bank reconcile will list the following transactions effective within the specified date range and bank code.

- Cash Transactions - un-reconciled only.

- Check Transactions - un-reconciled only.

- Journal Entries - All items.

Journal Entries cannot be reconciled, and are always included if saved to GL - 1100 (Cash in bank). The amounts are included in the reconciled totals.

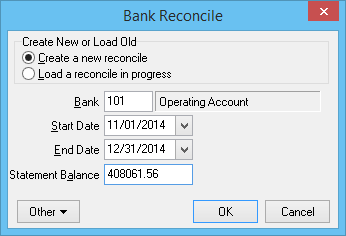

- Select GL -> Bank Reconcile.

- Enter the following details: (See bank reconcile fields above)

- Bank Code

- Start Date

- End Date

- Statement Balance

- Select Ok. All matching items will be displayed in date order, and can be sorted using the headers.

Process A Bank Reconcile

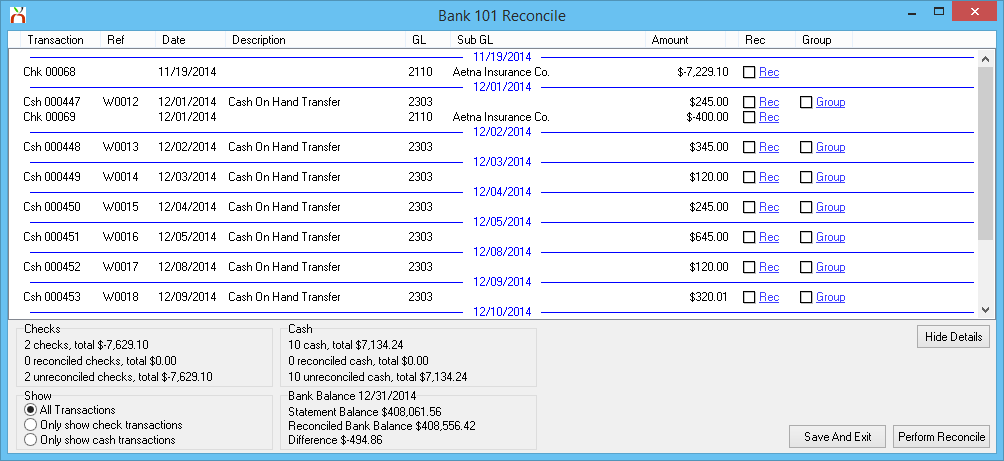

After starting a new bank reconcile, or loading an bank reconcile in progress, the transactions are compared to the bank statement for verification. Once verified, the transaction amount is included in the reconciled bank balance.

Marking Cash Transactions As Reconciled

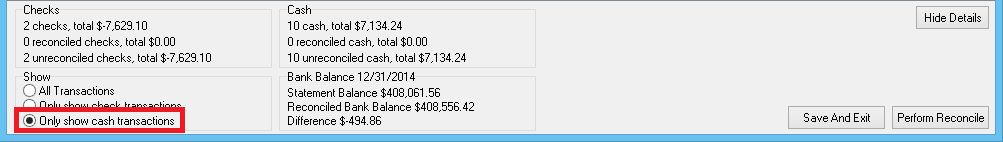

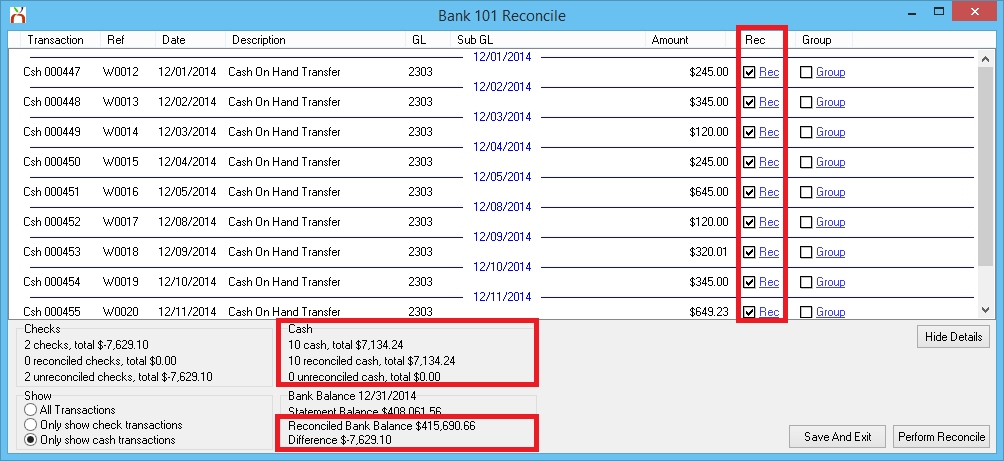

- Select Only Show Cash Transactions to filter the list.

- A single cash transaction for each daily bank deposit will be displayed. In addition, EFT cash received from carriers will also be listed.

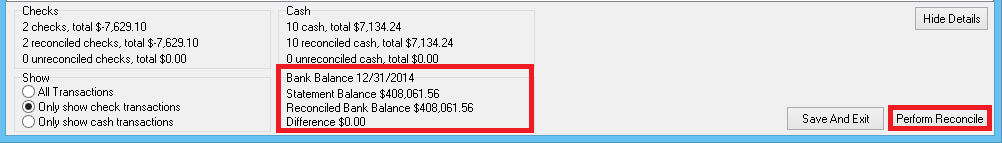

- Select the Rec checkbox for each cash item that matches the bank statement. The Cash totals and the Reconciled Bank Balance will be automatically updated as each item is selected.

Continue to: Marking check transactions as reconciled if check items are included.

If finished, see Perform (Complete) A Bank Reconcile.

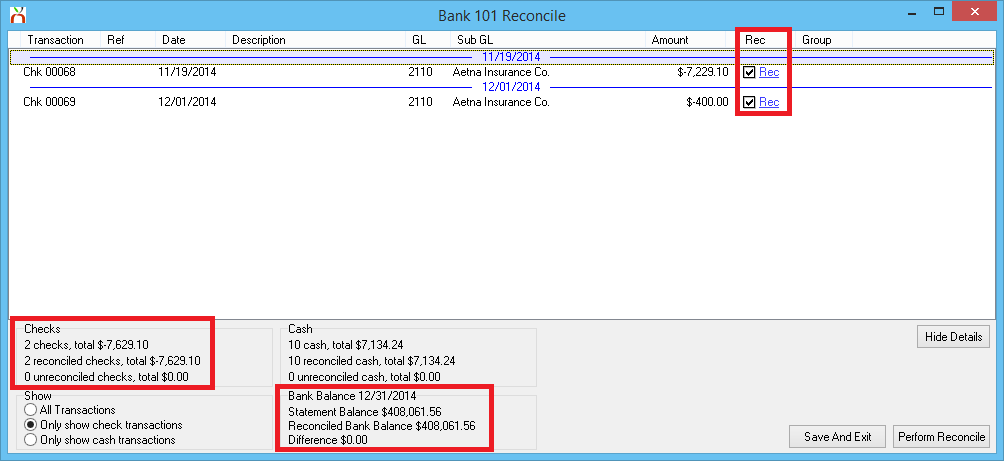

Marking Check Transactions As Reconciled

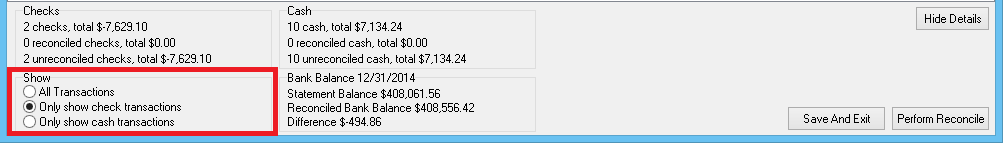

- Select Only Show Check Transactions to filter the list.

- Select the Rec checkbox for each check item that matches the bank statement. The Check totals and the Reconciled Bank Balance will be automatically updated as each item is selected.

If finished, see Perform (Complete) A Bank Reconcile.

Marking Journal Transactions As Reconciled

The journal amounts are automatically included in the reconciled bank balance value.

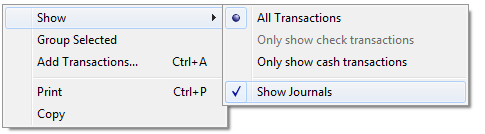

The line-item for each journal can be hidden from the bank rec screen through a new right-click option.

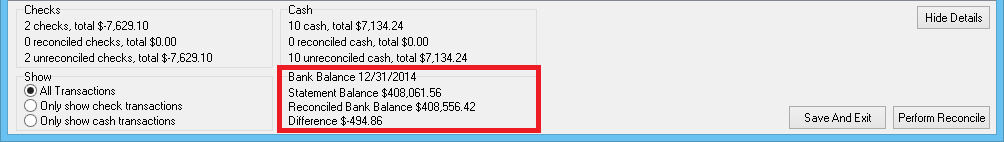

Perform (Complete) Or Save Progress

After all cash transactions and all check transactions are selected, the reconciled bank balance should match the statement balance, and the difference will be displayed as 0.00. Select Perform Reconcile to complete the bank reconcile.

To run a report for the completed reconcile, see: View Reconcile Archive.

To save the progress instead of completing the reconcile, select Save And Exit to save without posting any changes. The bank reconcile can later be resumed by loading a bank reconcile in progress.

Load Or Cancel A Bank Reconcile In Progress

Load A Bank Reconcile In Progress

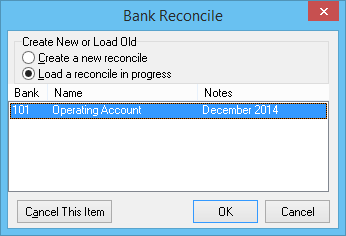

- Select GL -> Bank Reconcile.

- Select Load a reconcile in progress.

- Select the previously stored reconcile, and select Ok.

- The previously stored bank reconcile-in-progress will be displayed. Follow the steps to process the bank reconcile.

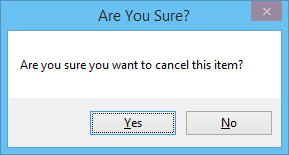

Cancel A Bank Reconcile In Progress

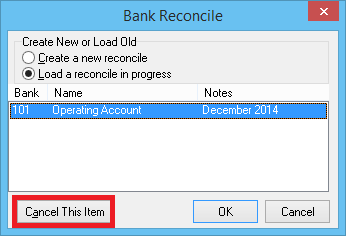

- Select GL -> Bank Reconcile.

- Select Load a reconcile in progress.

- Select the previously stored reconcile, and select Cancel This Item.

- Select Yes to confirm.

The stored reconcile-in-progress will be cancelled. Once cancelled, a new bank reconcile can be started for the same bank.

Bank Reconcile Screen - Additional Options

Select GL -> Bank Reconcile. Select Other to view additional options.

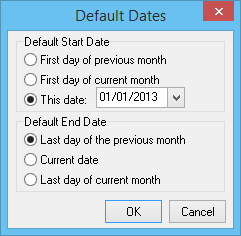

Change Default Dates...

- Select GL -> Bank Reconcile.

- Select Other -> Change Default Dates...

- The default Start Date and End Date can be adjusted with a number of options. It is recommended to set the Start Date to the day the agency starting using Agency Systems.

- Select OK when finished.

View Reconcile Archive... (Report For Completed Reconciles)

The reconcile archive lists all previously completed bank reconciles.

- Select GL -> Bank Reconcile.

- Select Other -> View Reconcile Archive...

- Select the previously processed reconcile, and select Report.